- accueil

- >

- Our skills

- >

- Mastering international taxation

Because ignoring a complex international tax situation and having to contend with a minimum of two tax administrations can cause major inconveniences, taking control and analyzing one’s tax situation can be beneficial very quickly.

Transfer of tax residence

The change of country of residence must be considered very precisely in order to validate all the consequences with regard to taxation (income, capital, transmission), social protection in the country of departure and in the host country.

Regime of the impatriates

France, like many other countries, offers an attractive preferential tax regime for impatriates. Taking the measure of the entire scheme (income and capital) and valuing its interest for both the company and the beneficiary is necessary, as is the proper fulfilment of the related reporting obligations.

The link between the country of origin and France will also have to be made in order to look at the situation as a whole.

Optimize international professional activity

The French tax system offers a wide range of possibilities for tax optimisation linked to the exercise of a professional activity outside France. Understanding and using them safely is a fair return on the personal efforts made in the workplace.

Moreover, the exercise of a professional activity in the territory of different States entails special reporting obligations and may make it possible to optimise its tax situation. Some prerequisites are necessary to avoid any unpleasant surprises.

To control and defend the taxation of its income and assets as a French resident or non-resident tax payer.

The existence of tax obligations in several States leads to reporting obligations and the payment of tax in different jurisdictions. Understanding the reporting obligations and ways of eliminating double taxation and their practical consequences makes it possible to anticipate the difficulties and be able to carry out one’s projects.

Tax litigation management

Effectively defending your tax situation is essential in complex international situations. From the request for information to legal action before the courts, each step requires real know-how.

From obtaining inaccessible administrative documents to responding to a request for information every step must be carefully weighed.

Regularize your international situation

It is essential to be well supported in the context of the regularisation of one’s tax situation and more particularly in the regularisation of financial assets located abroad. Although the derogation procedure with the STDR ended on 31 December 2017, this need for regularisation may nevertheless be necessary.

It may also be carried out with other tax administrations and a quality international network can enable this to be done.

The specific situation of dual Franco-American nationals also deserves to be dealt with effectively.

Taxation of Foreign Source Income

Content under construction

Content under construction

Content under construction

Content under construction

Content under construction

Content under construction

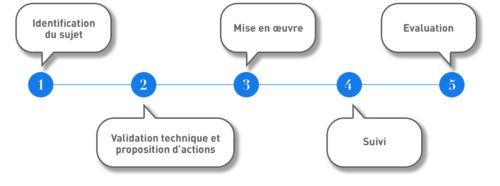

Our approach

According to the identified needs, we propose you a contact with an expert who will be able to validate the subject and propose an approach.