- accueil

- >

- Our skills

- >

- Managing and defending the taxation of your income...

Are you satisfied with your tax situation?

personal?

If one considers a personal tax situation, three indicators can be used to identify difficulties that require further examination by an expert.

Compliance with reporting obligations

The feeling of having to deal with complex or satisfied reporting obligations that, in part, may require the intervention of seasoned professionals to validate the procedures carried out, or even to make up for the shortcomings identified.

Follow-up of exchanges with the tax administration

The existence of requests for information or a tax audit may reflect the need to be assisted during the discussions with the tax administration and handled as part of the litigation process to be followed.

Managing an excessive tax burden

Many tax levies can be unjustified or miscalculated.

There are many recent examples of how refunds can be obtained quickly. It may be useful to review your situation and take the necessary steps before deadlines are closed.

Content under construction

Content under construction

Tax reporting obligations of individuals

Income Reporting

If you are French tax residents, you will have to declare in 2018 all your worldwide income received in 2017.

Filing a “paper” return before May 16, 2018 is possible for taxpayers who :

Have a reference tax income of less than 15,000 euros (2016 income),

Filing a declaration for the first time,

Do not have an internet connection,

Are unable to report online.

Online reporting, which is mandatory for other taxpayers, will have a later filing deadline that varies depending on where you live. The electronic declaration will make it possible to know the future withholding tax rate which will come into force on 1 January 2019.

The introduction of withholding tax will not remove this annual obligation for taxable persons.

If you are not French tax residents, you must declare in 2018 your French source income received in 2017.

You will have to file a form 2042 NR with the non-resident tax authorities:

In paper form before 16 May 2018.

Online before May 22, 2018, based on the same criteria as for residents.

The paper and online deadlines will be confirmed by a press release in early April 2018.

If one of the members of your tax household, including the spouse, is not a French tax resident, only the French source income of this non-resident member will have to be the subject of a tax return in France.

It should be noted that in the case of a property separation regime, the non-resident spouse must file a separate return with the non-resident tax authorities.

Reporting bank accounts and life insurance contracts abroad

The references of bank accounts and life insurance contracts abroad of members of the household who are French tax residents must be declared, under penalty of a fine, at the same time as the income subject to the reporting obligation.

Declaration of real estate assets submitted to the IFI

The gross value and the net taxable value of the assets must be mentioned on a specific declaration (form n° 2042-IFI-K) when declaring the income; the composition and valuation of the assets are to be detailed in the annex. No payment is required with the return.

Non-residents who file with the IFI but do not file an income tax return will have to file a special return by a date yet to be specified.

Other declarations by natural persons

Many other, non-periodic obligations may exist for natural persons.

Without the list being exhaustive, the following obligations can be mentioned:

– withholding and social contributions on dividends and fixed income investment products from foreign sources when the foreign custodian bank does not withhold (n°2777, 2777-D and 2778 and 2778-Div).

– the conclusion of loan contracts or the drafting of deeds recording them entail for natural or legal persons acting, as party or intermediary, the obligation to declare to the tax authorities the names and addresses of the lender and the borrower, the date, amount and conditions of the loan, in particular its duration, the rate and frequency of interest as well as the terms of repayment of the principal.

In principle, all loan contracts, whether verbal or written, interest-bearing or non-interest-bearing, whether or not they have been registered, must be declared.

– a trust whose administrator, if the settlor or at least one of the beneficiaries, has his domicile for tax purposes in France (on 1 January) or which includes property or a right situated therein or, if he is himself domiciled in France, has numerous obligations.

It is required to declare the constitution, modification or termination, as well as the content of its terms, within one month following the event.

He must also declare no later than June 15 of each year the market value on January 1 of the goods, rights and products falling within the scope of the levy provided for by Article 990 J of the CGI.

Content under construction

Change in family status

Family status affects the amount and calculation of income tax.

The latter is calculated according to the situation and the family expenses:

– January 1 of the taxation year,

– or December 31 of the taxation year if in the year there were an increase in the burden of family, marriage, civil union, divorce, separation or rupture of a civil union.

This situation must be completed and amended on the income tax return

if applicable.

You were married or entered into an agreement in 2017

o You must file a joint declaration in 2018 including the total income and expenses of both spouses for the year 2017.

o You can opt for the separate declaration

of your income for the year of your marriage (or PACS) and file individually in 2018 an income tax return for 2017 for each spouse.

o As far as the IFI is concerned, couples living in cohabitation (couples in a cohabitation or cohabitation agreement) are not covered by the IFI. no, same-sex or not) on January 1, 2018 are subject to joint taxation and must file a declaration for all their real estate assets.

You divorced or broke your marriage contract in 2017

o Each spouse must file a return with income in 2018 and its expenses for the entire year 2017.

o This is also the case under certain conditions if you have stopped your life together during the year 2017.

o With respect to the IFI, spouses who have separated from property and are no longer resident together as at 1 January 2018 must declare their real estate assets

separately. The same shall apply to spouses in the process of divorce who are authorised to live separately on 1 January 2018.

Your spouse (spouse or partner of a PACS) died in 2017

o Two declarations are due in 2018: A declaration in the couple’s name for the period’s income from January 1, 2017 until the date of death, A return for the surviving spouse for the income received from the date of death to December 31, 2017.

o The attachment of adult children is only possible on one of the 2

declarations.

o In certain situations, you may benefit from an increased number of units in the years following death.

Content under construction

IFI : Real Estate Wealth Tax

The natural persons concerned

French tax residents owning real estate assets located in France or abroad worth more than 1.3 million euros.

Non-French tax residents for their real estate assets located in France if their value exceeds 1.3 million euros.

Thanks to the application of tax treaties when they refer to the taxation of wealth, it will be possible to avoid, under certain conditions, double taxation in France and abroad of real estate located abroad for persons domiciled in France and French real estate for non-French tax residents.

In the absence of such a reference (e.g. Belgium, United Kingdom, Portugal), non-residents may be taxed more heavily by the IFI than they were by the ISF for their holdings in companies owning real estate assets located in France.

Taxable real estate assets

All property and real estate rights of the taxpayer and the members of his tax household on January 1 of the taxation year. Specific features exist in the event of the dismemberment of property or assets subject to leasing or lease-to-ownership contracts.

The novelty concerns the securities of companies held by the taxpayer and the members of his tax household for the fraction of their representative value of real estate assets held directly or indirectly by the company.

Taxation is no longer limited to real estate companies (assets more than 50% of which are real estate) covered by the wealth tax.

Taxation concerns listed or unlisted securities regardless of the form, tax regime or place of establishment (in France or abroad) of the company.

Taxation applies to rights held in collective investment undertakings such as SICAVs, FCPs or through redeemable life insurance contracts and capitalisation contracts.

Non-redeemable life insurance contracts are not affected by the IFI.

Exceptions allow certain assets to be excluded from taxation under certain conditions. These include:

Professional assets.

Investments of less than 10% in operating companies.

Investments of less than 5% of the capital and voting rights in a SIIC (listed real estate investment company).

Investments of less than 10% of the rights of an investment fund or collective investment undertaking if less than 20% of the assets of the latter consist of property and real estate rights taxable to the IFI.

The deductible liability

As for the ISF, it must exist on 1 January of the tax year, relate to taxable assets and be effectively borne by the taxpayer.

Eligible debts are fewer and are as follows:

Acquisition expenses such as bank loans.

Repair, maintenance, improvement, construction or expansion expenses.

Taxes due on the ownership of property (mainly property tax).

The amount of the deductible liability may be capped for taxable assets in excess of EUR 5 million. The deduction of loans in fine is limited.

The IFI cap

The cap is maintained. Thus, the total formed by the IFI and the taxes due in France and abroad on the previous year’s income must not exceed 75% of the previous year’s income.

In view of the income tax withholding tax introduced as of 2019, the ceiling mechanism will not apply for IFI 2019, in the absence of income tax 2018 to be taken into account.

Reporting and payment by the IFI

The gross value and the net taxable value of the assets must be mentioned on a specific declaration (form n° 2042-IFI-K) established at the time of the income declaration and according to the same deadline.

The composition and valuation of the heritage are to be detailed in the appendix. No payment is required with the return.

Non-residents who file with the IFI but do not file an income tax return will have to file a special return by a date yet to be specified.

The automatic exchange of information is developing and generating multiple questions.

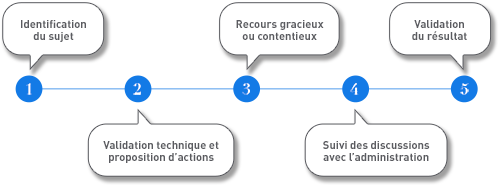

Our approach

According to the identified needs, we propose you a contact with an expert who will be able to validate the subject and propose an approach.